PNWFCU Blog »

Community & Events

Here’s How PNWFCU Supports Underserved Communities

Jul. 22, 2020We’ve been getting questions about how PNWFCU has helped our underserved communities in need of better financial services. What does PNWFCU do to promote financial education, help people build creditworthiness, and give to those in need?

PNWFCU was created in 1942 to serve people over profits, helping more people access loans and better rates that weren’t available at for-profit banks. We are owned by all of our members, so equal opportunity has been in our DNA from the beginning.

Here’s an overview of the community projects we’ve been working on lately.

Financial Education

Over the years, we’ve strived to teach financial skills to help people save money and break the paycheck-to-paycheck cycle. Our members have learned through educational seminars, free budgeting tools and other financial resources we provide.

Now this legacy continues with a new financial education program that we are excited to launch soon. We hired teacher Kristin Mullady to create financial lesson plans designed for students from kindergarten through grade 12.

The curriculum complies with Oregon State Standards. Schools will be able to implement the program for free, and even schedule Kristin to come teach in their classrooms.

The age-specific lessons will help kids understand how money works, how to save it, and how to manage it when they grow up. Our goal is to increase financial literacy in our communities and help prepare young people to feel confident handling their finances someday.

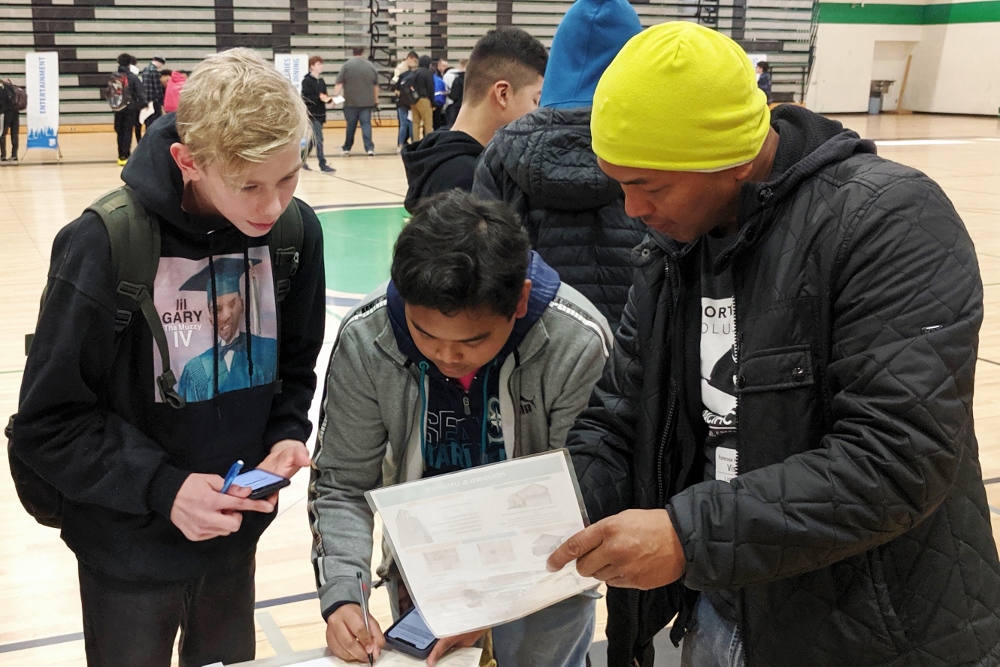

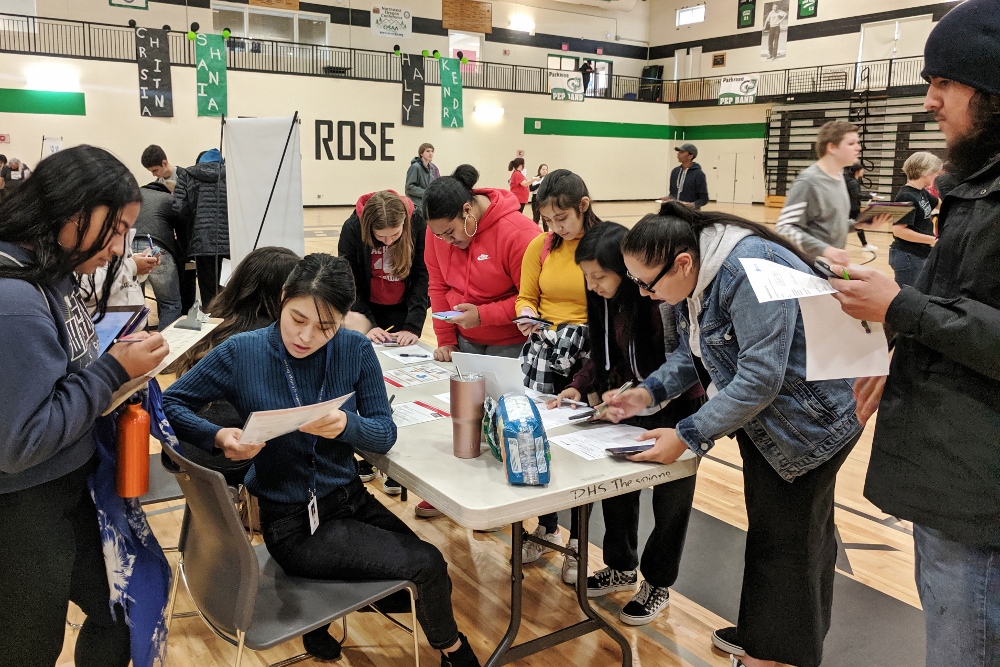

This will build on the work we’ve been doing through financial reality fairs at public high schools for years. We’ve helped high schoolers practice creating budgets and paying bills. Now we can reach more students with this new curriculum.

Charitable Donations and Volunteering

Headquartered in the historic Parkrose neighborhood, PNWFCU is surrounded by underserved kids and families living below the poverty line. Several local charities are working to help these families, and we regularly donate and volunteer to support their work.

Last year we donated over $12,000 in funds and school supplies for the Parkrose School District, supporting youth activities, the Parkrose Educational Foundation and the Sparrow Club. Learn more about our Parkrose donations.

One of our favorite community partners is Schoolhouse Supplies. This nonprofit provides supplies and backpacks for local kids who wouldn’t otherwise have them each school year.

Every child should have the tools they need to learn. Schoolhouse Supplies is making this happen, and we’re so happy support them. Next month we’ll be sending them $11,000 so underserved kids will have the supplies they need for remote learning this school year.

We also hold a toy and clothing drive each December. Last year we collected over $1,500 in gifts and warm clothing for the students at Sacramento Elementary in Parkrose. This is a Title 1 school where 40% or more of the students are from low-income families in need of assistance.

Local families are working hard to break out of poverty, and some of them are struggling to put food on the table. We donate to Oregon Food Bank to help people get the food they need, and our team often volunteers at OFB to help package food.

Check out our community page and recent annual reports for more information about the charities we support.

Access to Loans and Financial Services

Helping underserved populations also requires expanding access to financial services and loans. Communities need business loans, home loans and credit to grow and thrive financially.

PNWFCU membership is open to eight counties throughout the Portland metro and Hood River areas. That includes urban and rural neighborhoods that have historically been underbanked, or underserved with financial products. Anyone in those counties can join our credit union and apply for loans.

We make lending decisions based on creditworthiness. And with the financial education programs and first time buyer loans we offer, we hope to empower all of our members to build credit.

We’ve also grown our loan offerings to serve more people. For instance, our mortgage department offers more than just traditional home loans with large down payment requirements. We also offer several low or even zero down payment home loans, like our FHA, VA and USDA loans.

With our Home$tart program, low-income applicants can get up to $5,000 in grant funds for the down payment or closing costs on their first home purchase. Our members can also set up a First-Time Home Buyer Savings Account and get a tax break if they’re saving up to buy a house in Oregon.

Loan Relief

Sometimes life happens. We try to help our members get through tough times by providing loan relief and Skip-a-Pay solutions.

In times of hardship, we’ve worked with our members to arrange new terms or payment postponement on their home loans. During previous government shutdowns and, more recently, COVID-19 struggles, we’ve offered furlough and layoff loans.

Our loan team worked overtime this year to help business members get Paycheck Protection Program loans, so they could keep their businesses afloat and pay their employees during extended shutdowns.

We have a saying that we want to be Your Financial Partner for Life. That mission drives our decisions. We work every day to create more financial growth and opportunities for our members, and for those in our communities who need it most.