High School Financial Education

Prepare your students for life after high school by empowering them with personal finance skills. This high school financial education program includes everything you need to teach teenagers about money. Using these lessons, students can learn how to manage their money, plan for the future, and build a spending plan.

Review Lessons for All Grade Levels

Would you like to see a list of lessons for all grades? Click here for an index.

New Future Planning Courses Coming Soon

We are developing new high school courses in response to the latest recommendations of the Oregon Department of Education. Check back soon for more future planning lessons!

Access the High School Lesson Plans

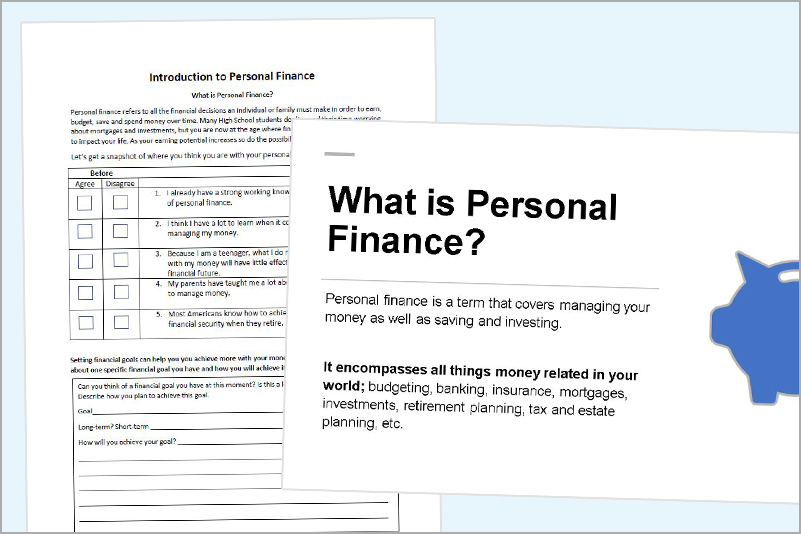

Module 1: Intro to Personal Finance

Many high school students don’t spend their time worrying about finances, but they are at the age where financial decision making is starting to impact their lives. This lesson will help students understand why personal finance is important, and gives the instructor an idea of each student’s comfort and knowledge of financial literacy. Lesson includes a pre- and post-assessment.

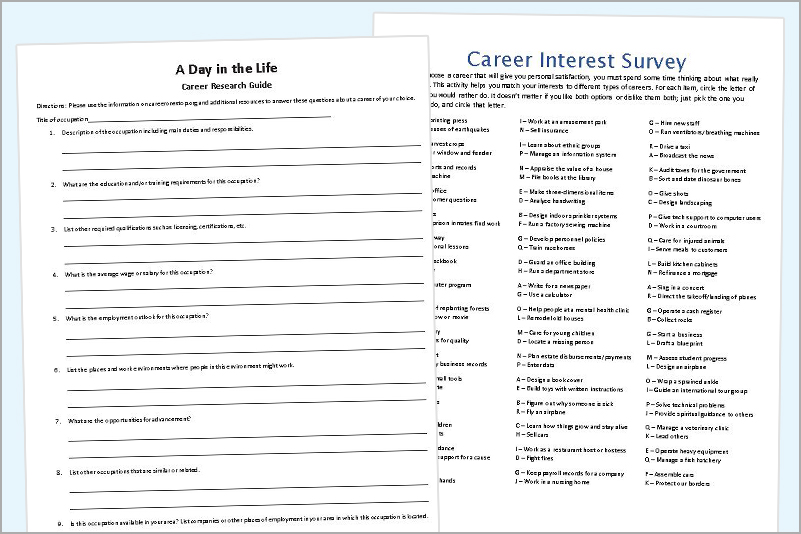

Module 2: Career Planning

Students will explore different career paths and interests by reflecting on their likes and dislikes to see which careers fit their personality. By the end of the lesson, students will understand the path they need to take to be qualified for the careers they are interested in, the availability of landing a job in that specific career, and what day to day life looks like once hired into the role.

Download Module

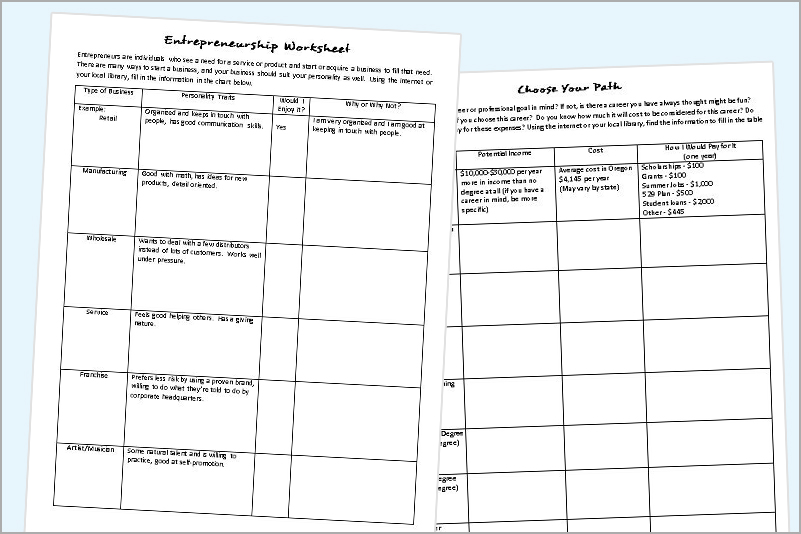

Module 3: Earning Potential

Students will understand how their earning potential increases with different levels of credentials. The first half leads students through an in-class discovery of personal potential. The second half teaches students about earning potential and possibilities.

Download Module

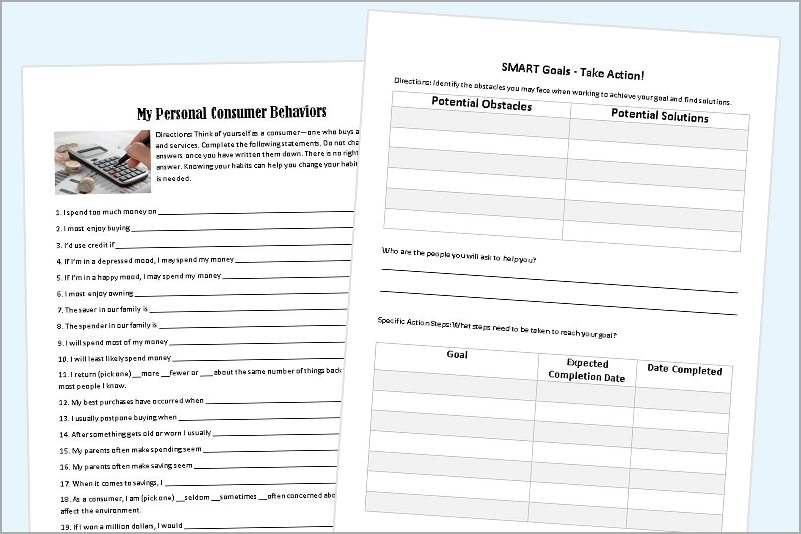

Module 4: Life Stages

Students will review the stages of their financial life and the potential impact certain actions can have on their life. Students will also reflect on their current spending habits to see if those habits align with the goals they have for the future.

Download Module

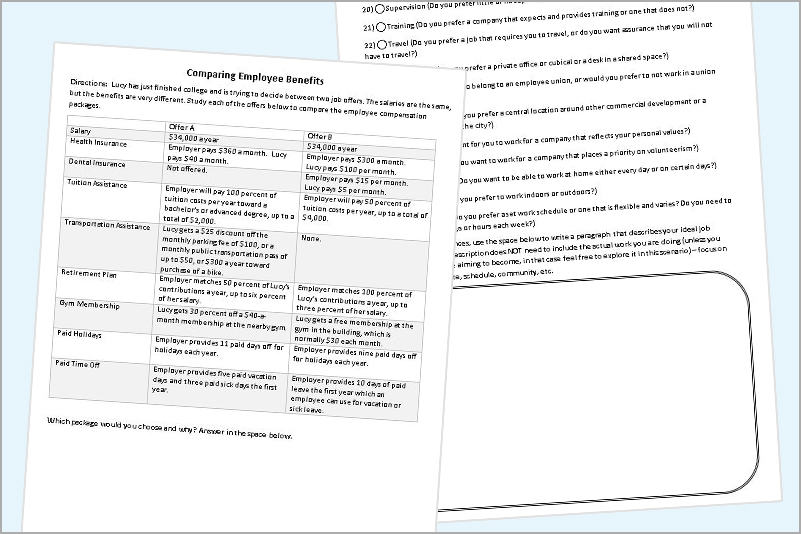

Module 5: Employee Benefits

Students will learn how to evaluate a job based on all the benefits of the job offer. Students will also think about which preferences are most important when looking for a job, like location or hours.

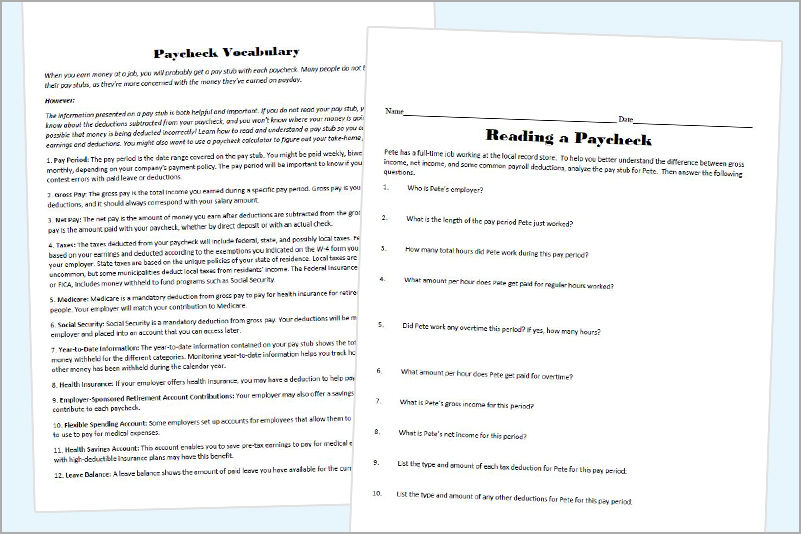

Module 6: Take Home Pay

Students will understand the parts of their paycheck and why the amount they earn is not the amount they get to keep. Net Pay and Gross Pay will be key components of the lesson.

Download Module

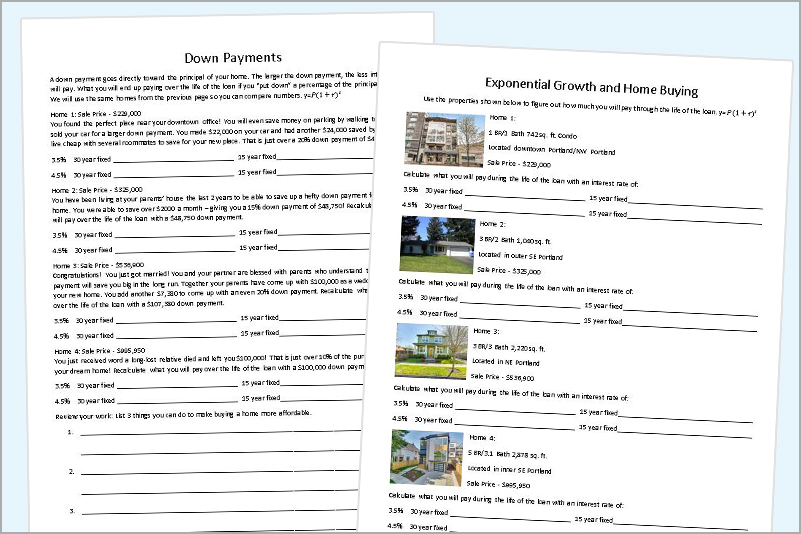

Module 7: Exponential Growth and Purchasing a Home

Students will learn how to calculate exponential growth, discovering how much they will pay for a home over the life of a loan. Worksheets feature Portland area homes and their sale prices.

Download Module

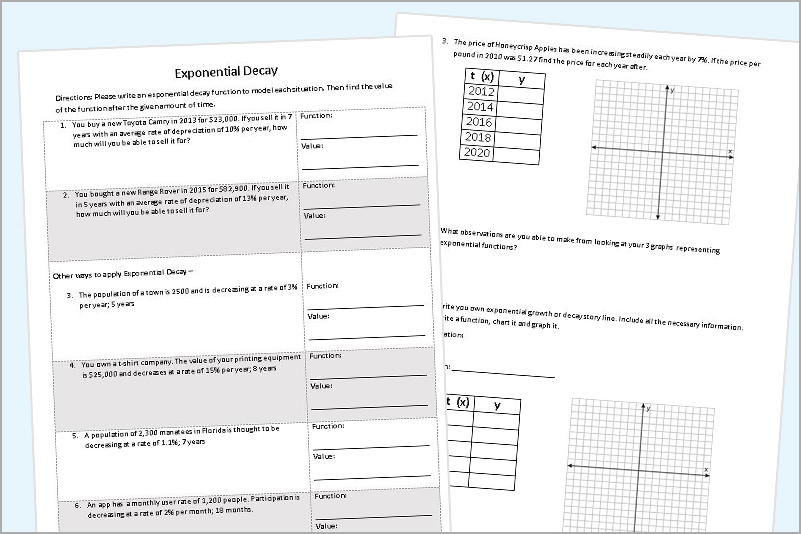

Module 8: Exponential Decay

Students will learn that some items depreciate over time, using the example of a vehicle. Students will learn how to change the exponential growth formula to represent decay, helping them understand the true cost of a new car.

Download Module

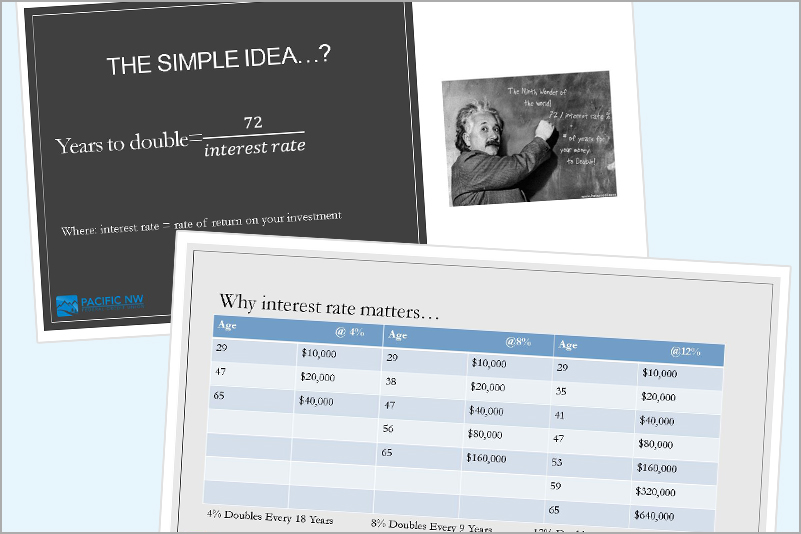

Module 9: Compound Interest

Students will learn the importance of compound interest and how time impacts their future investments. They’ll see that investing early can lead to future wealth.

Download Module

Module 10: Rule of 72

This mini lesson shows students an easy way to estimate how long it will take an investment to double. They’ll compare rates to see the difference in earnings.

Download Module

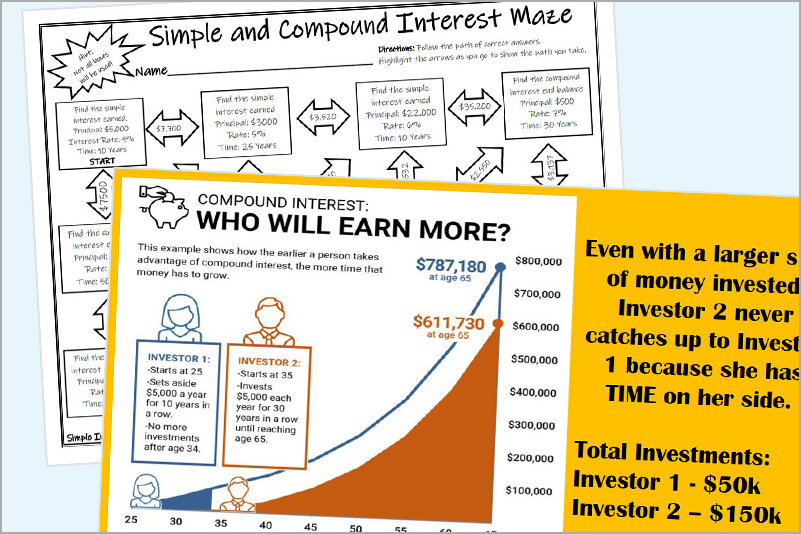

Module 11: Investing & Compound Interest

Who will earn more? Use loan and compound interest calculators to learn about interest in a fun and interactive way. Students should complete Module 9 before this lesson.

Download Module

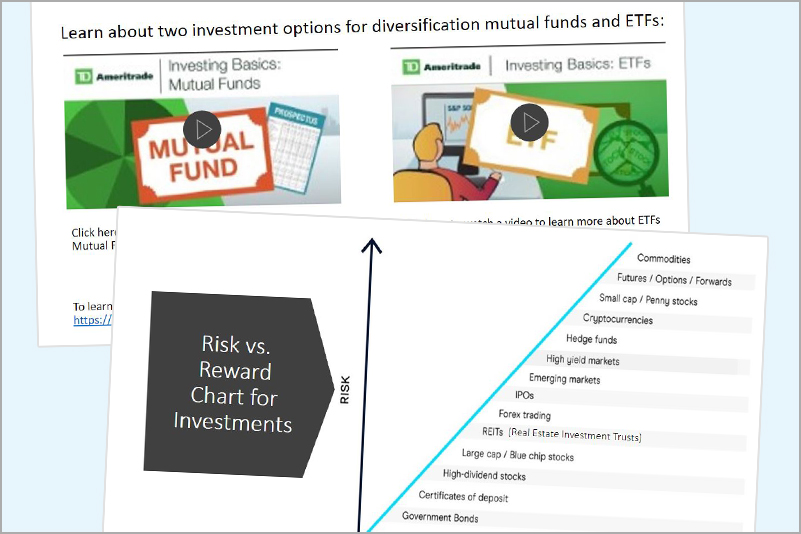

Module 12: Investing & Risk vs. Reward

Students will learn to assess risks of different investments and learn about common investment terms. Lesson includes a game to teach different investment strategies.

Download Module

Module 13: Investing & Cryptocurrency

Learn the basics of Bitcoin and other cryptocurrency, discuss blockchain, learn cryptocurrency vocabulary, and explore what has been driving the increased popularity of the digital currency.

Download Module

Module 14: The Stock Market

NEW! What is a stock and an IPO? What causes stock prices to change and how do you make money in the market? Learn important investment tools with this lesson.

Download Module

Module 15: The Great Depression and Recession

Learn the trends within the market that have led to previous crashes and the differences and similarities between the Great Depression (1929) and the Great Recession (2007).

Download ModuleFuture Planning Courses

Future Planning: Budgeting and Spending Wisely

Creating a budget is easy. Sticking to one? Much harder. Learn to build a budget that matches your needs, wants, and income. Lesson includes an income and spending tracker, and a weekly budget planner.

Download Module

Future Planning: Building Credit

Learn how to build credit, maintain, and improve a positive credit score. Learn what factors affect your credit score, what is a good score, and why a good score is important. Learn how to check your credit score for free.

Download Module

Future Planning: Resume Building

Create, format, and distribute a complete resume that accurately represents your skills, experience, and educational background. This lesson includes 8 important tips to get an interview!

Download Module

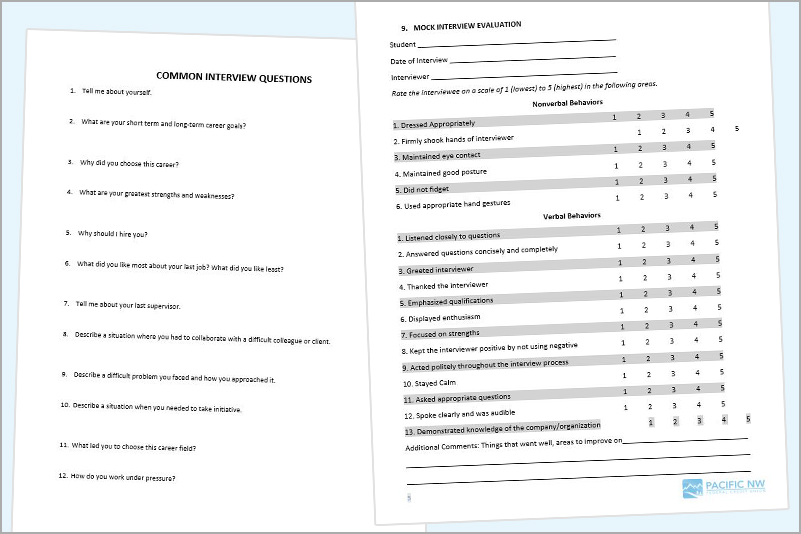

Future Planning: Interviewing Skills

Learn how to research jobs and internships, prepare for and practice interviews, dress for success, ask follow-up questions, and send a thank you letter. Don’t let education, experience or age stop you from applying!

Download Module

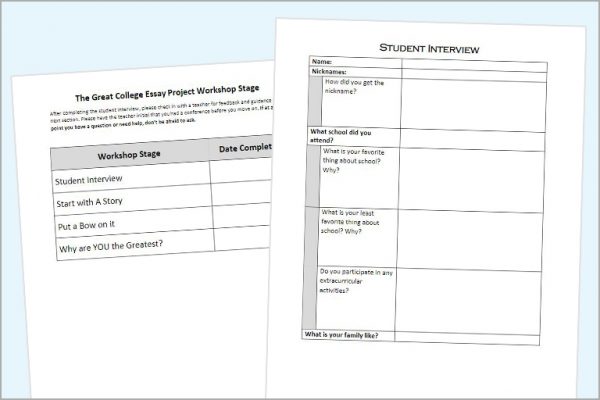

Future Planning: College Essay Writing

Writing essays for college applications and scholarships can be the biggest hurdle of applying. This course will take you step-by-step to write effective and compelling essays.

Download Module

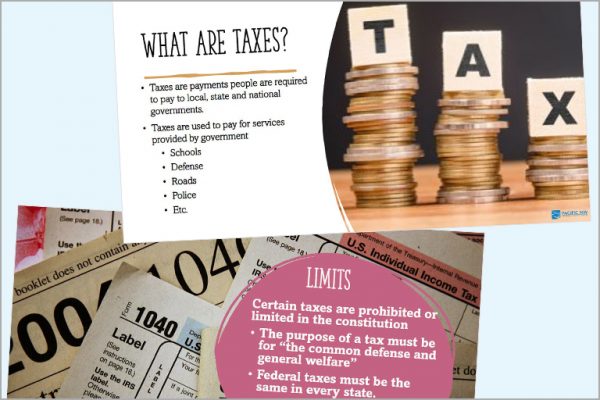

Future Planning: Taxes

Learn how taxes are created, the purpose of taxes, how taxes are used locally and nationally, the difference between gross and net taxes, and how to read a W-4.

Download ModuleReceive Updates on Financial Education Resources

Please note, we will only send you information about our financial literacy programs. You will not be added to any other mailing lists and you can unsubscribe at any time.

Join Our Facebook Group: Teaching Money Skills

Join our Facebook group to get access to the latest high school lesson plans, ask questions, and collaborate with other financial education teachers. Let’s work together to empower the next generation with the skills they need for life!

Questions or Suggestions? Get in Touch

Contact us with any questions, suggestions, or to request Kristin to teach in your classroom.

Quicklinks Title

Sub Headline

Lesson Index

Review All Lessons

Middle School

Financial Education

Elementary School

Financial Education