PNWFCU Blog »

Financial Growth

How Much Should You Save for a House Down Payment?

Aug. 31, 2022How do you know whether you should try to buy a house now, or save up for a 20% down payment?

This calculator can help you compare all the costs of buying a house with a smaller down payment now versus a larger down payment later. Here’s how it works!

Mortgage Down Payment Calculator

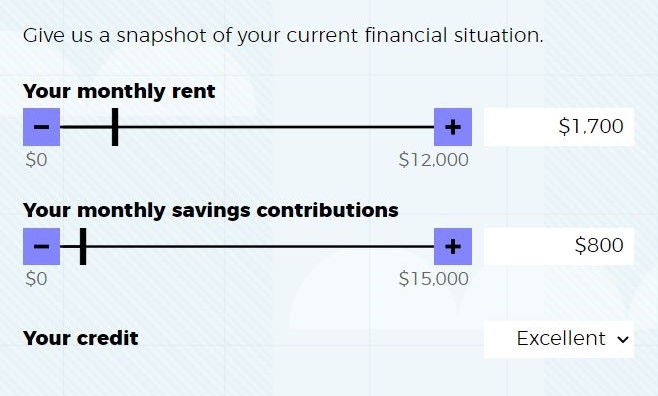

Once the calculator loads, click start. Then enter your rent payment and the amount of money you plan to save each month. Let’s say you’re paying $1,700 in rent with a great savings rate of $800 per month.

Then select your approximate credit score from the dropdown. We’ll assume it’s a high score, and click next.

Now you can enter details about your mortgage. In the Portland area, you might be looking at houses around $595,000.

For a 3% down payment, you would need $17,850, and let’s assume an interest rate of 5%. You can check mortgage rates here to get the most up to date number.

Click to the next screen to view your results.

Understanding the Calculator Results

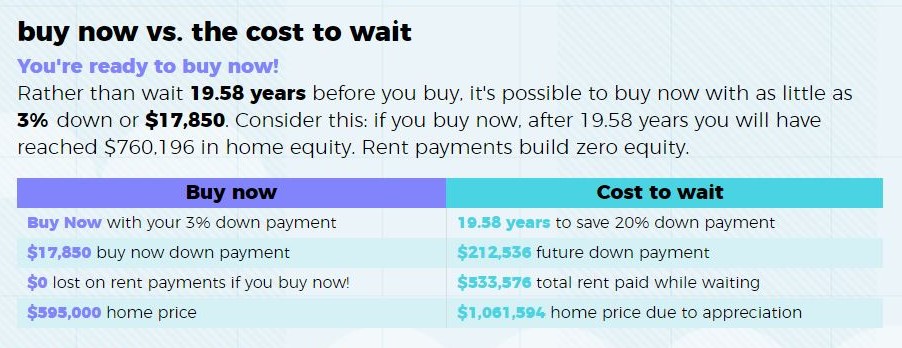

You can see with a consistent savings rate of $800 per month along with the appreciation of housing costs, it could take about 20 years to save a 20% down payment. In that time, you would spend over half a million dollars on rent payments.

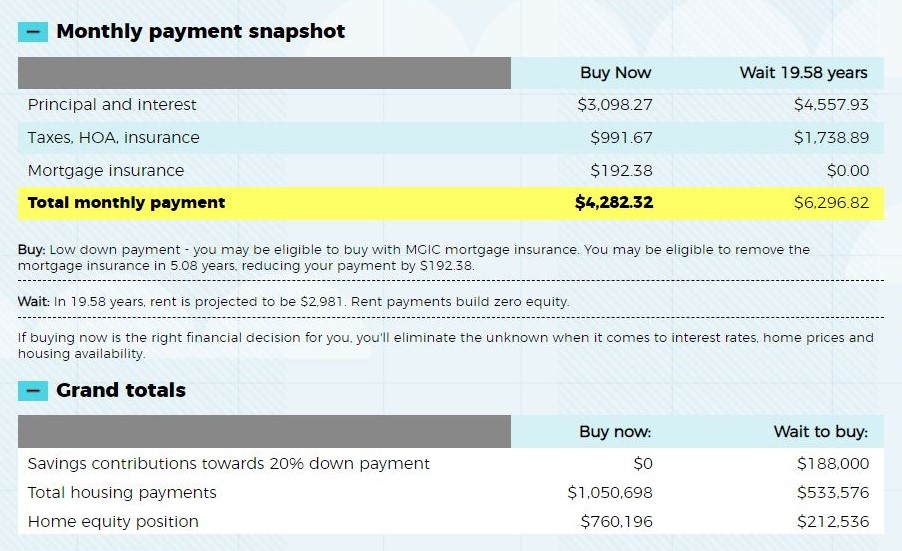

Under monthly payment snapshot, you can see how your mortgage payment might be affected by waiting, due to the increase in the cost of the home.

When you expand the grand totals section, you can compare how much you would need to save up for your down payment and how much you might spend on housing over the next 20 years.

If you bought a house now, you might spend more on housing, but then you would earn much more in equity in that time, compared to the 20% equity you would get with your higher down payment after 20 years.

More Calculator Settings

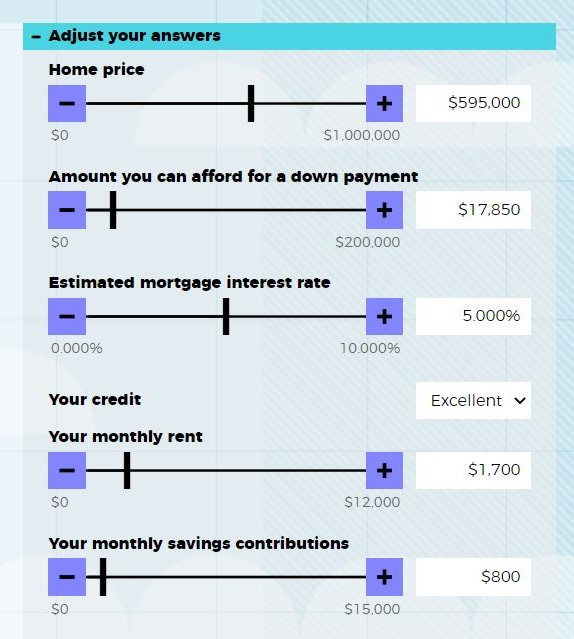

In the sidebar, you can adjust your answers to see how a different home price, down payment or mortgage rate could change the results.

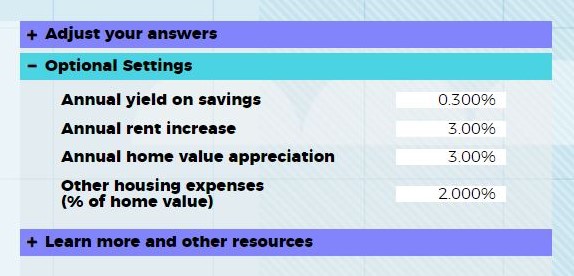

And under optional settings, you can tweak your expected savings yield, rent increase, home appreciation and housing expenses. For instance, if you live in a competitive housing market area, you might expect rent and home prices to increase at a faster rate.

Home-Buying Resources

The housing market has been difficult for first time buyers trying to break in, but the good news is you don’t always have to have that huge 20% down payment. There are loan options with much smaller down payments to make it possible to buy a home and start building equity.

Read about our home loan options and contact our mortgage team to learn more.