PNWFCU Blog »

Financial Growth

Your Money Is Safe With PNWFCU

Mar. 16, 2023

With the recent headlines regarding the FDIC shuttering banks, we realize you may have questions about the money you have deposited in your credit union.

Don’t worry, your money is safe with PNWFCU! The National Credit Union Share Insurance Fund (NCUSIF) was created by Congress in 1970 to insure members’ deposits in federally insured credit unions. No credit union member has ever lost a penny of savings held in a federally insured credit union.

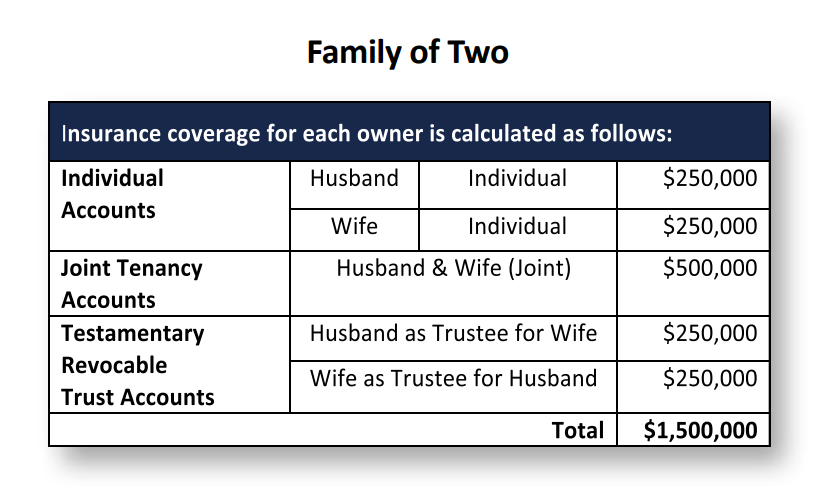

The standard share insurance amount is $250,000 per share owner, per insured credit union, for each account ownership category. But as we’ll show you, there are simple ways that you can insure your money for even higher amounts. All members of federally insured credit unions have options for coverage that is separate from and in addition to the coverage available to their single ownership account – such as Joint Accounts, Retirement Accounts, and Trusts.

How To Set Up Your Accounts For More Coverage

As you can see in this example, with simple structuring of your savings, a family of two can be protected for $1.5 million!

Chart Source: Your Insured Funds

Insurance Can Add Up

There are many ways you can structure your accounts if you have more than $250,000 to make sure it is insured. For example:

- Each individual’s account deposits are insured up to $250,000.

- If you have a joint account, you can insure an additional $250,000, and your partner can insure $250,000, for a total of $500,000.

- IRA accounts are insured separately up to $250,000. However, a member’s Roth IRA will be added together with his or her traditional IRA and insured in the aggregate up to $250,000.

- Formal and Informal Revocable Trust accounts are insured separately for an additional $250,000 per beneficiary, for each owner. Special rules apply to accounts over $1.25 million.

Important Share Insurance Information

- Your savings, checking, certificate, IRA, and Trust accounts can be insured by NCUA. Investment products offered by a credit union to its members, such as mutual funds, annuities, and other non-deposit investments are not insured by the NCUSIF.

- Accounts you may have at other credit unions do not affect your NCUA insurance coverage at PNWFCU.

- Your money is automatically insured when deposited at PNWFCU. However, you need to review your account ownership (as in the example above) to ensure that all of your funds are adequately insured.

- Review your accounts periodically and whenever you open new accounts or modify existing accounts to ensure that all of your funds remain insured.

Are Business Accounts Insured?

Yes, business accounts are insured separately from the personal accounts. However, any personal funds that the owner keeps in the business account will count toward the $250,000 limit of the business.

Helpful Resources

- NCUA’s Your Insured Funds booklet has many examples of how you can structure your money for maximum coverage. Helpful hint: Pages 32-33 of the booklet have useful charts (such as the one above) to use as examples for couples and families.

- The NCUA has a toolkit with helpful videos, brochures, and other publications.

- To confirm your coverage, try the NCUA’s share insurance estimator. You can input your own accounts and balances and check if your deposits are adequately insured. Then print and save it for reference later!

Your Money Has Been Safe With Us for Over 80 Years

For more than 80 years, PNWFCU has provided you with solutions to help you meet your short- and long-term financial goals. We are here to be your financial partner for life! Email us if you have any questions about your coverage, or if there is anything else we can help you with.